Capital Improvement Programs (CIP) consist of multiple moving parts, people, and processes. In fact, the majority of work performed on an owner project is delivered by contractors and vendors from multiple, external, companies.

To protect against astronomical fees that can result from injuries, property damage, and misunderstandings between parties, each contractor and vendor that is involved in a project need insurance coverage as does the company they work for.

Many factors dictate the type of construction insurance coverage needed based on the contractor or vendors’ scope of work and their relationship to the project — contractor, property owner, subcontractor, etc. All this data, along with policy information and expiration dates, need to be managed in the owner Program Management Information System (PMIS).

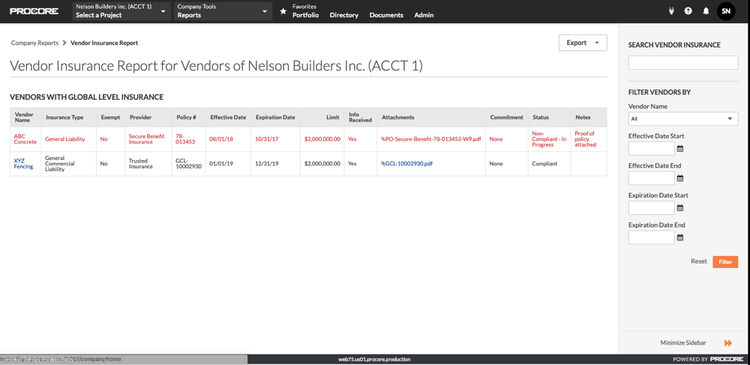

Tracking Insurance in Procore

Systems like Procore enable owners with the capability to manage insurance related risk. Procore Insurance Tracker maintains critical insurance information for each contractor and vendor, providing a central repository for all key data in one location. At any point in the project’s life-cycle, imperative insurance related data can be accessed.

In addition, Procore Insurance Tracker can be integrated with leading Insurance systems available in the marketplace, for real-time accurate data on any contractor or vendor, at any time.

For more information on Tracking Insurance in Procore or the OnIndus, Procore partnerships contact us!