Real estate or infrastructure management is a complex process of balancing the maintenance of current assets with investments in long-term ones. In addition to repairs and maintenance ensuring structures remain functional, capital improvements enhance the asset’s value, efficiency, and lifespan. Proper recognition of the difference between them is essential, especially in financial reporting and tax management.

In this blog, we will mention capital improvements, how they differ from repairs and maintenance, and how to plan and execute these projects effectively.

What is Capital Improvement?

Property owners can enhance their buildings through capital improvements that create permanent benefits that add value and increase long-term usage potential. The initiative puts money into significant improvements that boost asset functionality beyond essential restoration.

Examples of Capital Improvements:

- Roof installation

- Building expansion

- HVAC system upgradation

- Adding accessibility equipment with features like elevators and ramps.

Key Characteristics of Capital Improvements:

- Long-term Benefit: Improves the asset’s value or functionality over an extended time.

- Structural Enhancement: Often involves physical changes to the structure.

- Costly Investments: The expansion of any property requires significant financial resources and proper planning.

These improvements involve high costs. Therefore, it falls under capital expenditures rather than operational expenses.

What are Repairs and Maintenance?

Repairs and maintenance are the tasks that are done to preserve the property to stay the same or to bring it to operational condition without significantly increasing its value or extending its lifespan. These are everyday duties that sustain the safety of a building and make sure that it is operational all the time.

Examples Include:

- Fixing a leaky roof.

- Repainting walls.

- Replacing broken windows.

- Servicing HVAC systems.

Key Characteristics of Repairs and Maintenance:

- Short-term Focus: They are meant to address immediate matters.

- No Value Addition: This does not enhance the property’s worth or functionality.

- Lower Costs: Usually, these are the less expensive options than capital improvements.

While repairs and maintenance are essential for property upkeep, they do not increase the property’s overall value.

Key Differences Between Capital Improvements and Repairs & Maintenance

This table highlights the fundamental distinctions between capital improvements and repairs/maintenance, emphasizing their respective roles in property management.

| Aspects | Capital Improvements | Capital Repairs & Maintenance |

| Purpose | To increase property values | The work is to restore the original condition, and no expansion is needed. |

| Duration | Permanent changes or expansion. | Temporary fixes or repairs are required. |

| Cost | Expansion requires significantly higher costs. | Repairs or fixes do not involve higher investments and generally lower costs. |

| Tax Treatment | Depreciated over time | Fully deductible in the year incurred |

| Example | Adding a room or swimming pool, upgrading HVAC, etc. | Fixing HVAC units, replacing HVAC systems |

What is Considered a Capital Improvement?

Not every upgrade qualifies as a capital improvement. In the U.S., guidelines provided by the IRS are used to determine what qualifies:

- Structural Modifications: Additions such as extra rooms, decks, or garages.

- Energy-Efficiency Upgrades: Installation of solar panels or energy-efficient windows is part of the energy efficiency upgrade program.

- Accessibility Enhancements: Adding wheelchair ramps, handrails or tactile paving

- Modernization: Upgrading to innovative building systems.

These projects must exist for over a year to qualify as a permanent capital improvement. Keep proof of all work through invoices, contracts, and permits to claim during tax filings.

Steps for Planning and Executing a Capital Improvement Project

Assessment and Planning

Assessing property conditions and the areas that need to be renovated is the first step in any capital improvement project. These involve the following:

- A comprehensive inspection of the property is conducted.

- The first step is determining the potential return on investment from each renovation.

- Developing a detailed project plan that outlines objectives, timelines, and budgets.

Obtaining Permits

For any significant work to be carried out, getting a clear idea of the local regulations regarding permits is necessary. Most capital improvement projects need permits to ensure compliance with building & safety code standards. This process usually consists of:

- Showing the plans to local authorities.

- Submitting the necessary fees.

- Conducting the required inspections during construction as per schedule.

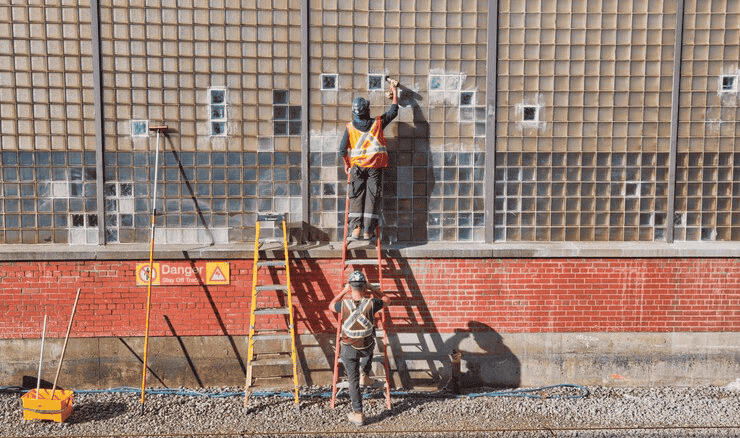

Hiring Qualified Contractors

Getting skilled & qualified contractors is important for executing the project. Property owners should keep in mind the following things before hiring contractors:

- Choose a few potential contractors’ qualifications and experience to be examined.

- Get quotes from different contractors to make the best deal.

- References are the source to pick and reviews from previous clients.

Hiring those who have already succeeded will ensure the project’s success team will save time and money.

Tax Treatment of Capital Improvements

Capital owners must understand the tax implications of any capital improvements. The IRS takes a different approach with these expenses than it does for the repairs:

- Depreciation: Instead of being fully deductible in the year they are incurred, capital improvements must be depreciated over time. This means owners can recover costs over multiple years.

- Cost Basis Adjustment: The expenses incurred for capital improvements can be added to the property’s cost basis, potentially reducing capital gains taxes when it is sold.

Leveraging Digital Solutions

Modern technology organizes the planning, implementation, and management of capital improvements more systematically. e-Builder can provide strong tracking and documentation of costs for capital improvements, repairs, and maintenance, helping minimize administrative burden while providing transparency of the expenses to each member involved.

Digital Tool Benefits in Capital Improvement Projects:

- Expense Tracking: The ability to monitor costs in real time makes it easier to keep projects within budget.

- Document Management: e-Builder provides centralized document storage for data (contracts, permits, and reports) that can be accessed by anyone, anywhere.

- Collaboration: Enables smooth communication between all parties involved.

Using e-Builder streamlines processes and reduces errors, especially on complex projects.

Conclusion

It is important for property owners and managers to know what capital improvements are and how they differ from repairs and maintenance. To make the most of their capital investments—implementing well-thought-out steps when preparing and executing capital improvement projects, leveraging the e-Builder software, and keeping their properties competitive.

Using e-Builder simplifies, streamlines, and cost-effectively implements capital improvements. Many strategies have one thing in common: whether you are an owner, contractor, or capital project manager, adopting such practices can help ensure your assets remain valuable.

Ready to optimize your capital improvement projects? Contact OnIndus today to see how we can transform your approach to construction project management.